The dollar is currently overvalued by about 35 percent. [1] Consequently, US producers must sell their goods for 35 percent less than if the dollar were fairly valued. This applies equally to the prices of exports and to the prices of goods that must compete with "the China price" of imports – the price at which countries like China can sell goods in America.

In short, the overvalued dollar places a severe tax on U.S. producers. America cannot eliminate its trade deficit, restore millions of jobs, or create a thriving economy unless it removes this severely burdensome overvalued dollar tax.

Overvalued Dollar Tax is worse than the Corporate Income Tax

The Overvalued Dollar Tax is an especially heavy burden because it is imposed on the final selling price of made-in-America goods, not on profits like the despised Corporate Profits Tax (CPT). This is critically important.

If a business has a profit margin equal to 15 percent of the selling price, the CPT takes 35 percent of the profits -- or 5.25 percent of the selling price. In contrast, a 35 percent ODT takes over 200 percent of the profit when the profit margin is 15 percent, leaving the company with a substantial net loss.

A very important corollary is the following: Reducing the corporate income tax rate does nothing to help firms that are making zero profits or losses. The benefit of reducing the corporate tax rate from 35 percent to 20 percent when a producer’s net income is zero is exactly that – zero. It does nothing to stimulate jobs, output, or investment. On the other hand, implementing the Market Access Charge (MAC), which affects the final selling price, can massively increase after tax profits – even if the corporate income tax rate remains the same.

Until the dollar is restored to its equilibrium value, firms will continue to fire workers, reduce output, close plants, and move offshore. Nobody can stay in business with a tax that can exceed 100 percent of profits! Compared to the overvalued dollar tax, the business profits tax is relatively unimportant. It is the overvalued dollar tax that must be fixed before we can restore the American dream.

Overvalued Dollar Tax: Foreigners win - U.S. loses

Nobody likes taxes, but at least normal tax revenues generally stay in America. However, the Overvalued Dollar Tax is entirely different – it goes directly to foreign producers. The ODT effectively gives foreigners a 35 percent subsidy on their exports and places a 35 percent tax on our exports. Truly the worst of all taxes.

Because the ODT kills American businesses and jobs, it puts pressure on the US Government to raise taxes to make up for revenues lost because of falling business profits and family incomes, and to help cover the high costs of corporate bailout, economic stimulus, and family income support programs.

Despite shortfalls in revenues and sharp increases in expenditures, Congress has understandably resisted pressures to raise taxes. Consequently, the ODT has caused Government deficits and borrowing to explode.

Even worse, nearly 100 percent of the net government borrowing in recent years has been from abroad, mainly from China and Japan. Such borrowing is far worse for the American economy than domestic borrowing because it adds to total domestic spending power and thus to inflation, making it even harder for U.S. producers to compete. And thanks to fractional reserve banking, the impact on total domestic spending power may be up to ten times as large as the initial borrowing.

Overvalued Dollar Tax and the External Deficit Doom Loop

The overvalued dollar is driving an "External Deficit Doom Loop" that condemns our children and future generations to a bleak future unless the dollar returns to a trade-balancing equilibrium rate. The doom loop works as follows:

- The dollar's value rises as foreign capital assets seek yield and safe haven in America's attractive financial markets.

- Because of the rising dollar, trade deficits increase, further increasing foreign capital inflows.

- Trade deficits create a bias against direct foreign investment by making production in America less profitable.

- Consequently, the share of speculative in total foreign investment rises. This adds to financial instability and, by increasing asset values in U.S. financial markets, pushes the dollar’s value even higher.

- Borrowing capital from abroad rather than from domestic savers is like printing money, so inflation increases.

- With higher domestic prices, US firms can't compete with foreign producers, and business profits fall.

- With reduced profits, firms cut back on investments needed to increase productivity – or move offshore. U.S. firms also sell domestic production capacity to foreign investors, further reducing the strength of the economy for future generations.

- As firms shrink or move offshore, personal incomes fall and jobs disappear, worsening US unemployment.

- Even if real assets sold to foreigners remain in the United States, foreigners, not U.S. citizens, will own the future income streams from these assets, further reducing the ability of future generations to repay our debts to foreigners. And attempting to reclaim these assets by force, a.k.a. nationalization, would lead to unthinkable legal, economic and perhaps even military complications.

- With falling business profits and household incomes, Government revenues fall and expenditures on bailouts for families and businesses rise.

- The Government borrows more from abroad, facilitating currency manipulation by China and Japan.

- Currency manipulation overvalues the dollar further, and the External Deficit Doom Loop starts again.

Restoring the American Dream – Prosperity for All

Excessive demand for dollar-denominated assets in the United States, home to the world's finest financial markets and issuer of the world's premier reserve currency, is the key cause of the dollar's over-valuation. The best way to moderate the dollar's overvaluation is to moderate foreign demand for these assets. The following summarizes the key measures under discussion today for attaining this goal.

Restoring Competitiveness for Specific Products and Sectors.

The legislation recently discussed in Congress focused on increasing the effectiveness of countervailing duties (CVDs) by adding a surcharge treating currency undervaluation due to currency manipulation as an additional countervailable subsidy.

Product-specific ADDs and CVDs are legal and can play an important role in protecting U.S. firms from unfair trade practices. However, CVDs only cover about one percent of all US imports and do nothing to stimulate exports. Furthermore, the proposed duties would apply only to imports from countries declared as "currency manipulators" – and such countries only account for fraction of the dollar's total overvaluation.

Competitiveness for the Entire Economy

Although product-specific duties can help at the firm and sectoral levels, additional policies are needed to handle the far larger problem of overall currency misalignment -- a problem that may be caused by official currency manipulation or by private sector capital flows seeking profits in the global economy.

Fighting Currency Manipulation: In the past, currency manipulation

as defined by the IMF was a significant cause of the currency misalignment with countries such as China. This gave manipulating countries an unfair competitive advantage over U.S. producers.

To fight misalignment due to manipulation, the United States should consider

Countervailing Currency Intervention (CCI) as suggested by Fred Bergsten and Joe Gagnon. Under this proposal, whenever the Government of China, for example, intervened in international currency markets by purchasing, say, $100 million worth of dollars with $100 million worth of its domestic currency to drive down the domestic currency and drive up the foreign currency, thus attaining a competitive advantage in international trade, America would respond in kind by purchasing a like volume of yuan with dollars, thereby countervailing China’s original purchase of dollars. The same would apply to any country attempting to manipulate the dollar’s value.

This approach appears to be legal and would be an excellent way to target country-specific exchange rate distortions caused by manipulation, thus responding to wide-spread support in Congress and the Administration for ways to counteract country-specific threats caused by currency manipulation. On the other hand, it would probably be necessary to raise the U.S. debt ceiling before the U.S. could undertake sufficiently large purchases of foreign currencies, and even though this would not technically increase the budget deficit because assets of like value were being swapped, the optics could make this a heavy lift.

Furthermore, since no country that is a significant source of U.S. trade deficits is manipulating its currency today, the main value of the CCI approach at present would be to warn countries that any future attempts to manipulate currency values would be countervailed and rendered ineffective.

Fighting Currency Misalignment with the MAC: Even when China was actively manipulating currency values in the first decade of this century, currency manipulation per se was only a small subset of overall currency misalignment. The broader problem of currency misalignment was and still is caused primarily by private capital flows – flows that respond to opportunities to make profits in global financial markets.

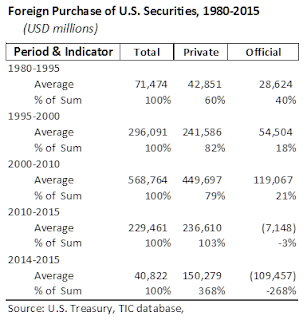

The dominance of private capital flows is seen clearly in the two graphics below:

Two key messages emerge from these graphics. First, official flows were only about one fifth the size of official flows on average between 1995 and 2010. Second, between 2010 and 2015, official flows became negative on average, while private flows were sufficient to make total net inflows positive.

In other words, even if 100 percent of all official flows had been for currency manipulation during the past twenty years, the impact of those flows would have been significant only for selected cross rates such as the dollar vs. the yuan, and they would have been largely insignificant for the dollar’s overall value. Second, official flows are now negative. This eliminates any possibility that active currency manipulation is a significant cause of the overvalued dollar tax today.

Given this stark reality, balancing U.S. trade will clearly require far more than countervailing currency manipulation. Instead, it will require a major effort to moderate the inflow of private capital that pours into the United States because our first-rate financial markets offer such good profits and security.

The Market Access Charge (MAC) is specifically designed for this task. By reducing the net yield on foreign-source capital seeking access to US financial markets, the Market Access Charge (MAC) would moderate such inflows, allowing the dollar to return to its trade-balancing equilibrium exchange rate. (For more details on the MAC, see

How the MAC Would Help Restore American Manufacturing.)

Summary

While countervailing duties will help solve unfair trade practices for specific products and sectors, and while countervailing currency intervention will help reduce bilateral trade deficits if and when individual countries begin manipulating their currencies again, the only way to eliminate the dollar’s overall overvaluation and thus America’s overall trade deficit is to implement a Market Access Charge (MAC).

March 13, 2015

(rev. March 16, 2017)